In today’s energy economy, accurate and fast valuation is the cornerstone of confident investment and development. Whether assessing a single battery energy storage system, optimizing a multi-state renewables portfolio, or managing a large fossil fuel portfolio, stakeholders require dynamic, high-resolution valuation tools that go beyond static spreadsheets. The REX™ Enterprise Platform delivers exactly that, an automated, data-driven valuation engine built for scale, speed, and precision.

From Data to Financial Insight

The REX™ platform begins with a rock-solid data foundation. Acelerex delivers a full suite of data services designed to fuel rich financial modeling:

- Price Forecasting: AI and statistical modeling across 2+ million pricing nodes in the U.S.

- Revenue Forecasting: Simulation of dispatch-based earnings across energy, capacity, and ancillary markets

- OpEx and CapEx Modeling: Tailored operating and capital cost forecasts with customizable assumptions

- Market & Weather Intelligence: Utility rates, emissions, and climate variables integrated for location-based analysis

- Market Intelligence Reports: Granular performance and opportunity data for emerging and mature markets

Together, these services transform raw data into credible, investment-grade financial projections.

Valuation at Unlimited Nodes

Energy asset values can vary dramatically across markets even across nodes. That’s why REX™ enables valuation at unlimited pricing nodes in the United States, giving developers and investors a strategic edge in site selection, congestion analysis, and locational revenue optimization.

Model thousands of locations simultaneously to pinpoint high-yield zones, analyze congestion pricing impacts, and forecast nodal-level project returns. This is valuation that mirrors real market dynamics.

Dynamic Modeling for Evolving Projects

The REX™ platform allows you to simulate, iterate, and optimize across the lifecycle of a project. It supports:

- Pro forma generation at the asset or portfolio level

- IRR, NPV, DSCR, and MOIC calculations under various dispatch and price scenarios

- Investment comparisons based on financial sensitivity and market exposure

- Multi-technology modeling for standalone and hybrid systems

- Integration with clean energy policies and regulatory incentive structures

You don’t just model potential—you strategize with precision.

Use Cases That Drive Strategic Decision-Making

While REX™ excels in asset valuation, its reach goes far beyond spreadsheets:

- Portfolio Screening: Prioritize project siting, M&A, or repowering with economic clarity

- Integrated Resource Planning: Align grid and regulatory strategy with financial outcomes

- Energy Storage Optimization: Simulate control strategies for peak-shaving, arbitrage, and capacity payments

- Policy & Incentive Design: Use bottom-up analytics to forecast program ROI

Each use case benefits from REX™’s ability to marry operational data with financial forecasting, keeping you ahead of both market and regulatory curves.

Built for the Enterprise

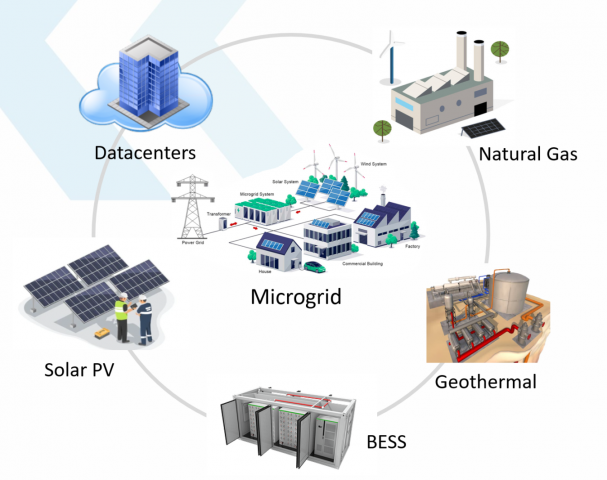

REX™ is engineered to scale—from a single Geothermal project, to dozens of gas turbine power plants, to 100s of MWs of solar and BESS project to enterprise-wide energy portfolios.

Features include:

✔ Automated model refreshes with live market data

✔ Scenario libraries and version tracking

✔ Secure cloud-based or on-prem deployment

✔ Transparent logic and auditable workflows

✔ Modular architecture that integrates with your internal systems

The result is a trusted platform that evolves with your business needs.

Acelerex REX™: Turning Strategy into Financial Performance

At its core, Acelerex’s REX™ Enterprise Platform helps you answer the most important question: What is the financial potential of your energy project, and how can it perform over time?

Whether you’re optimizing dispatch, planning a utility-scale portfolio, or responding to evolving market rules, REX™ delivers automated, intelligent analysis to guide every step—from first screening to long-term monetization.

Ready to Elevate Your Valuation Strategy?

Connect with our team to schedule a demo or explore how REX™ can power your energy investment decisions.

Contact us at [email protected]

___

Explore More Insights from Acelerex:

○ Data-Driven Valuation for Natural Gas Projects in Competitive Markets

○ Driving Energy Transition with Acelerex’s Grid Analytics Software Suite